About Brendan Stafford

Staffords Wealth Management – Financial Advisers currently taking on new clients by appointment.

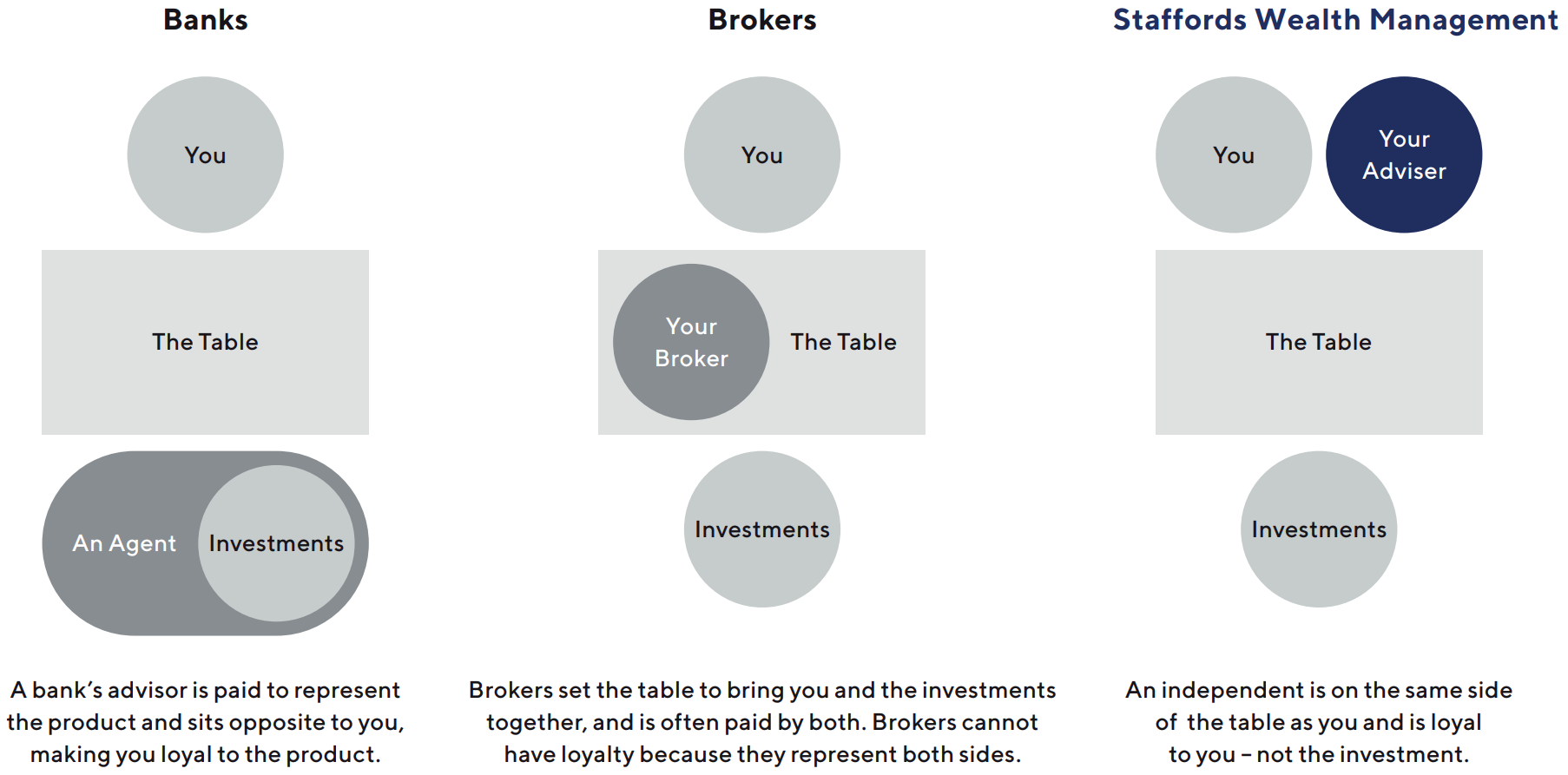

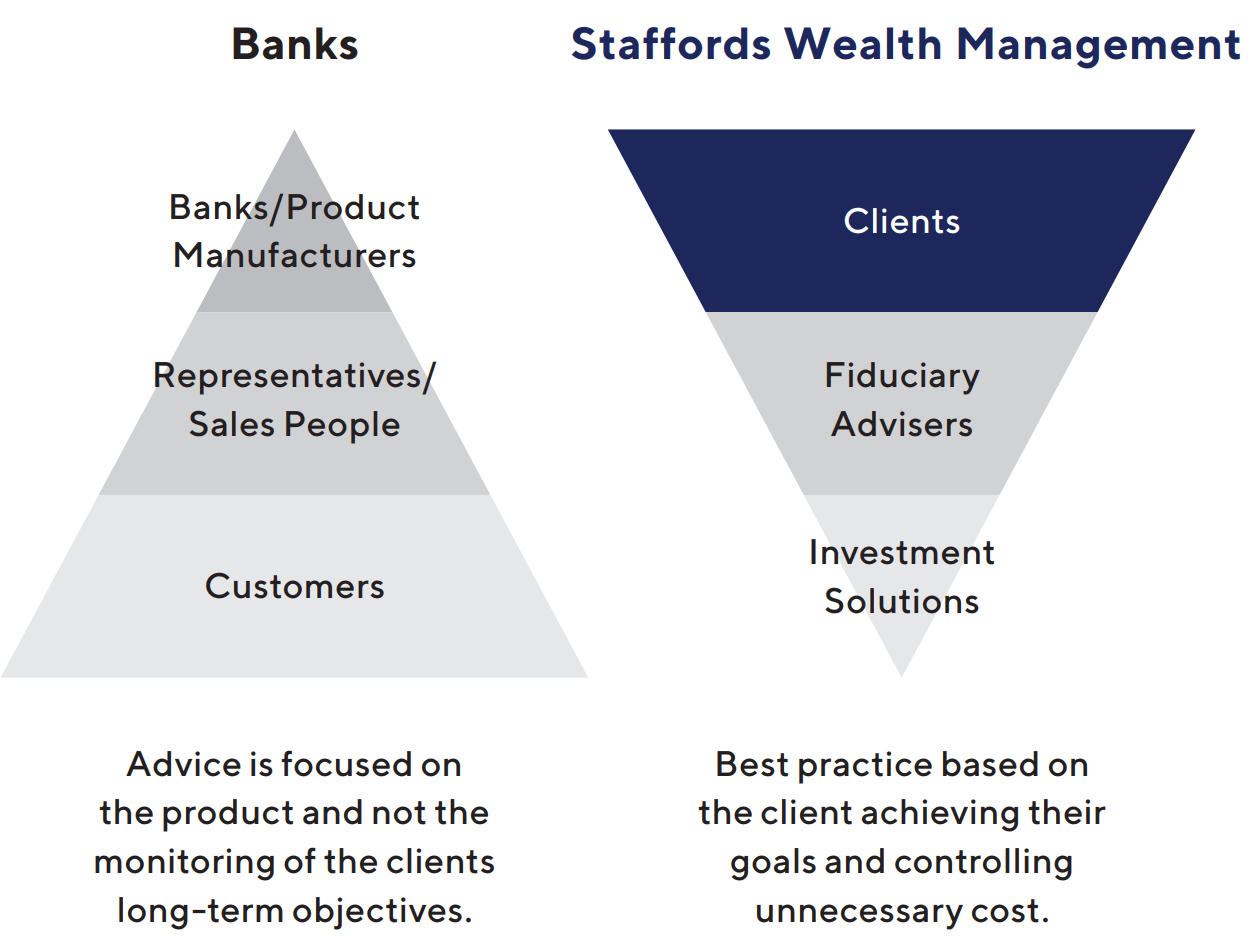

I am an Independent Financial Planner, which first and foremost means I am completely client-focused. As an independent advisor, I am able to provide you with strategies to protect and grow your wealth without any risk of commissions or partners influencing this advice.

This enables me to focus on my values and provide clients with the right solutions based on their needs and interests, not those of a large organisation.

My approach to building a portfolio is personal and based on experience. Diversification, Fees, Tax Efficiency, and Liquidity are the four pillars to providing the right solution.

I offer a completely bespoke, tailored investment and KiwiSaver solution. My services are fully individualised and designed to meet your Personal Financial Planning needs.

It is never too late to build a plan; for an initial consultation, please get in touch.

The value of independent advice

At Staffords Management Wealth, we believe advice starts with you. By understanding where you stand, what you want to achieve and what your intentions, values and objectives are, we’re able to build the foundation for a meaningful and rewarding journey.

We take a holistic approach to investment and develop a tailored strategy for each client. After meeting with you to learn about your goals, we look at a range of factors to help you achieve your investment goals and live a more fulfilling life.

To give you a better understanding of how your wealth can energise your life, we keep you involved in your portfolio and sit down with you to complete a full annual review. We regularly review your risk and rebalance your portfolio when needed.

Our approach to investing is grounded in tried and tested strategies and industry best practices. We’re prudent and practical and won’t jeopardise your wealth with unpredictable or unnecessarily risky investments. Being independent gives us the freedom to advise in line with global best practices and prioritise what we can control for our investors. You can expect investment discipline, lower fees, and advice based on what you are actually trying to achieve.

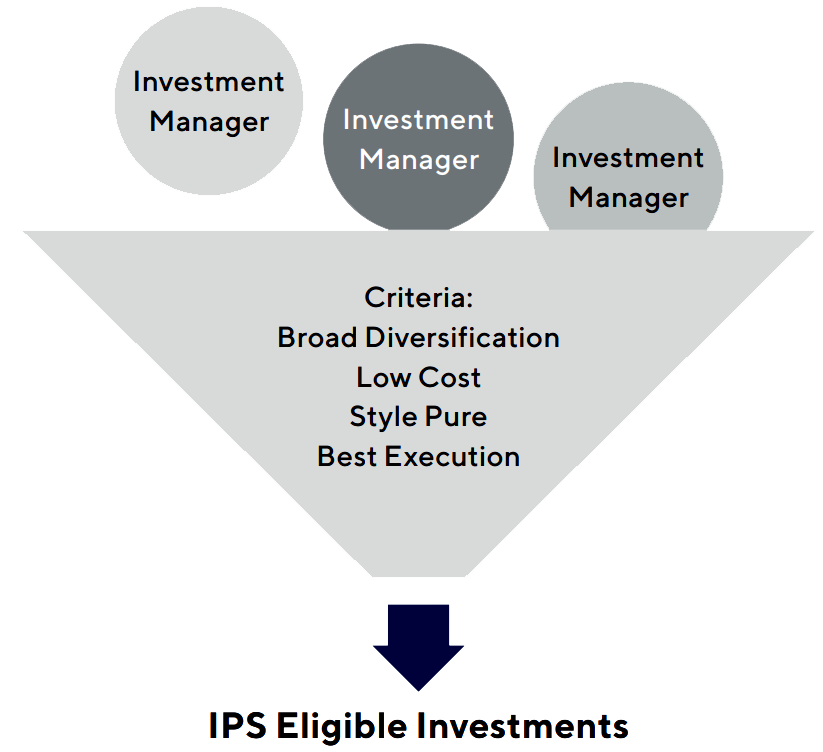

How we recommend funds

Our investment advice begins with your goals. As independent advisors, we can pick and choose from the entire spectrum of investment options available to New Zealanders. We start by learning about your financial goals, cashflow needs, and personal risk tolerance, then review all of the available options and design a solution to meet your needs.

This is where our independence comes into its own; because we’re not allied with any specific investment providers, our recommendations are always based on research and evidence.

We avoid the conflict of interests that can arise in traditional investment models, where the advisor may have internal targets to meet or an ownership stake in the funds they’re recommending. We’re completely objective and impartial and work entirely on your behalf. You can have complete confidence that when we make decisions that impact your portfolio, we’re always acting in your best interests.

Why independence matters

As independent fiduciary advisors, we avoid the conflicts of interest that comes from traditional models of investment because we aren’t investing in funds you have built or have an ownership stake in. It delivers greater objectivity, impartiality and better governance overall; letting us truly align your best interests whenever we make decisions that impact your portfolio because we don’t have any mandate to sell particular products or remain tied to others. For example, if you own a fund that doesn’t perform, you can’t fire yourself from the investment selection. We believe this ultimately leads to higher speculation and greater risk being placed on your financial security